Global Investors: Global Developers Basic of Property Investment

1. Who are the prominent international players in the Indian Market ?

Since the Real Estate Sector was opened for Global Investors in 2005, there are several Renowned Private Equity investors & Renowned Developers in the Indian Real Estate Sector

With the Further relaxation of FDI norms, the participation is only expected to improve.

| Major Funds entered India | Blackstone, Abu Dhabi Investments |

| Global Architect in India | US based HOK architect, US based Pei Cobb Freed & Partners, DP architects and Hellmuth Obata Kassabaum Inc |

| Engineering, Procurement & contracting firms | UK based Severfield stuctures tied up wth JSW steel ; Fluor, Bechtel, Brookfield, AECOM |

| Project management consultants | MACE, Parson Brinkerhoff, Louisberger |

| Material suppliers | OTIS, PERI, hilti |

| Facilities Management Services | Leading international property consultants |

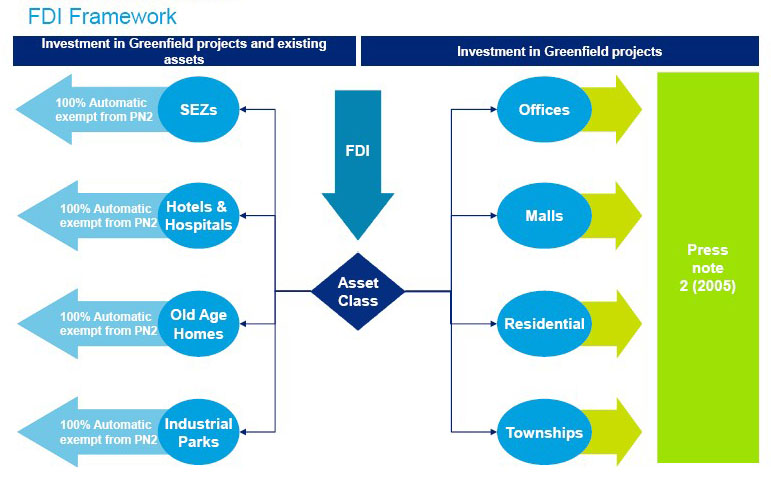

2. What are the Indian Government Real Estate laws for International Developers or Investors ?

A reduction in the size of projects eligible for FDI from 50,000 sqm to 20,000 sqm and halving the minimum investment limit for FDI to $5million.

PLANNING YOUR ENTRY

From the perspective of choice on instruments, the flavor of investments changed from preferred equity to structured debt, and several funds today are keen to act pure play lenders. There is also keen interest to look at real estate focused NBFCs and few players like Xander, Red Fort and others have set up their NBFCs, while a few of the other larger players are gearing up to set up the NBFCs. The listed NCD route that allows foreign institutional investors to purchase listed debt securities issued by a private real estate company has become increasingly popular.

PLANNING YOUR EXIT

From an exit perspective, unlike some of the developed markets where REITs play an important role in the exit strategy, exits in the Indian context are modeled in a combination of the following ways:

Strict and Prolonged Regulatory process leading to DELAYs

According to the report of the committee on streamlining approval procedures for Real Estate (SAPREP) set up by the ministry of Housing and Urban Poverty Alleviation, a developer has to follow at least 34 regulatory processes to obtaining construction permits and it takes an average of 227 days.

To address the issues in granting construction permits, the Government is evaluating the single window clearance mechanism.

Several Cities in India such as Ahmedabad, Chennai, Cochin, Madurai, Ghaziabad, pune, Trivandrum, delhi and kozhikhode have already implemented the automated system for approving building plans.

TAX LAWS AFFECTING REAL ESTATE INVESTMENTS

Transfer of real estate in India is subject to stamp duty (in the nature of transfer tax payable to the revenue) which is payable on the instrument for transfer of real estate. Stamp duty differs from State to State. The rate of stamp duty varies depending on the transaction. For instance, the sale of real property in Maharashtra is required to be stamped at 5% of the consideration paid by the buyer. Note that the consideration for the purpose of stamp duty and registration cost cannot be lower than the price prescribed by the State Government, even though the actual sale may be transacted at a lower valuation. Transfer of real estate would also be subject to capital gains tax as set out in the Income-tax Act, 1961. The rate of capital gains tax would depend on the period of holding the asset under consideration. Income tax Act makes provision for taxation of income arising from international transaction between associated enterprises.

This a Basic PROJECT INVESTMENT PROTOCOL

Successful property investing calls for CAREFUL PLANNING ensuring Investment Balance:

The Basic Criteria in Property Selection CHECK LIST: